Zeb 摆烂

boosted

Zeb 摆烂

boosted

Zeb 摆烂

boosted

Zeb 摆烂

boosted

Did your pampered regime of choice, say, the Soviet Union, spice'n'shiet it's own statistical measurements like this when it existed?

>Just over a year ago, we commented on the "massive" revisions that the statistical arm of Biden administration's Department of Energy - the Energy Information Administration (EIA)...

>[from @zerohedge] "The Biden admin will not stop fabricating data and draining the SPR to push the price of oil lower"

>Adding to those who questioned the 'fabrication' that:

>[from @zerohedge] "When is the last time demand estimates were revised lower"

>Zoom forward a year and the 'revisions' across multiple (government-supplied) macro data items are now well known and widespread... and statistically noteworthy that the revisions tend to be negative (implying the initial data was 'optimistic')...

>Payrolls (7 of the last 10 months have seen downward revisions)...

>Consumer Confidence (9 of the last 12 months have seen confidence revised lower)...

>The situation has become so widespread that even the mainstream media is forced to admit that there is something odd going on.

>Specifically, circling back to our initial thoughts, Reuters reports this morning that a string of dramatic revisions to official U.S. oil consumption data have unnerved market participants who rely on the figures to trade.

>The EIA published a monthly update last week that showed U.S. oil consumption at a seasonal record in May as motorists burnt more gasoline than even before the pandemic.

>That data conflicted with weekly updates published that month showing oil and fuel demand struggling to even match last year's levels.

>The EIA says the weekly figures for May were off because preliminary readings overestimated gasoline output and undercounted exports. The agency does not expect weekly estimates to be as accurate as monthly data, but to be consistent in showing general trends.

>Of course it just happens that the initially 'weak' demand figures helped lower crude and gasoline prices at a time when inflation was rearing its ugly head once again and Bidenomics was hitting the wall. And as is the case with payrolls revisions (or consumer confidence), traders reactions to the revisions are dramatically less sensitive than they are to the original prints.

>However, as Reuters reports, these discrepancies (we are being polite) are starting to make market participants question the version of reality they are being sold.

>"It makes you wonder why anyone is paying attention to the weekly numbers," said Tom Kloza, head of energy analysis at Oil Price Information Service (OPIS). Many fuel marketers have expressed disbelief over the revisions the EIA made to its numbers in May, he added.

>A trader at one of the largest commodities distribution firms said the revisions left them befuddled, and warned such changes could ultimately hurt consumers as decisions on how much fuel to import are influenced by the EIA data.

>"It's a trend that's a little concerning to me," GasBuddy analyst Patrick De Haan says.

>"The EIA has been the bedrock for analysts, but skeptics may be gaining more validity to arguments that the EIA numbers aren't jiving to the real world."

Jivin' to the real world, you say?

zerohedge.com/energy/numbers-arent-jiving-real-world-huge-revisions-leave-traders-questioning-biden-admins-energy

>Just over a year ago, we commented on the "massive" revisions that the statistical arm of Biden administration's Department of Energy - the Energy Information Administration (EIA)...

>[from @zerohedge] "The Biden admin will not stop fabricating data and draining the SPR to push the price of oil lower"

>Adding to those who questioned the 'fabrication' that:

>[from @zerohedge] "When is the last time demand estimates were revised lower"

>Zoom forward a year and the 'revisions' across multiple (government-supplied) macro data items are now well known and widespread... and statistically noteworthy that the revisions tend to be negative (implying the initial data was 'optimistic')...

>Payrolls (7 of the last 10 months have seen downward revisions)...

>Consumer Confidence (9 of the last 12 months have seen confidence revised lower)...

>The situation has become so widespread that even the mainstream media is forced to admit that there is something odd going on.

>Specifically, circling back to our initial thoughts, Reuters reports this morning that a string of dramatic revisions to official U.S. oil consumption data have unnerved market participants who rely on the figures to trade.

>The EIA published a monthly update last week that showed U.S. oil consumption at a seasonal record in May as motorists burnt more gasoline than even before the pandemic.

>That data conflicted with weekly updates published that month showing oil and fuel demand struggling to even match last year's levels.

>The EIA says the weekly figures for May were off because preliminary readings overestimated gasoline output and undercounted exports. The agency does not expect weekly estimates to be as accurate as monthly data, but to be consistent in showing general trends.

>Of course it just happens that the initially 'weak' demand figures helped lower crude and gasoline prices at a time when inflation was rearing its ugly head once again and Bidenomics was hitting the wall. And as is the case with payrolls revisions (or consumer confidence), traders reactions to the revisions are dramatically less sensitive than they are to the original prints.

>However, as Reuters reports, these discrepancies (we are being polite) are starting to make market participants question the version of reality they are being sold.

>"It makes you wonder why anyone is paying attention to the weekly numbers," said Tom Kloza, head of energy analysis at Oil Price Information Service (OPIS). Many fuel marketers have expressed disbelief over the revisions the EIA made to its numbers in May, he added.

>A trader at one of the largest commodities distribution firms said the revisions left them befuddled, and warned such changes could ultimately hurt consumers as decisions on how much fuel to import are influenced by the EIA data.

>"It's a trend that's a little concerning to me," GasBuddy analyst Patrick De Haan says.

>"The EIA has been the bedrock for analysts, but skeptics may be gaining more validity to arguments that the EIA numbers aren't jiving to the real world."

Jivin' to the real world, you say?

zerohedge.com/energy/numbers-arent-jiving-real-world-huge-revisions-leave-traders-questioning-biden-admins-energy

Zeb 摆烂

boosted

Zeb 摆烂

boosted

Zeb 摆烂

boosted

Good to see that TFM can still smell the bullshit when it's fresh.

Did you know the murderer who killed the 3 girls in the UK was promoted by BBC and starred in one of their "Children in need" videos? Of course they deleted it, but you can still find it online.

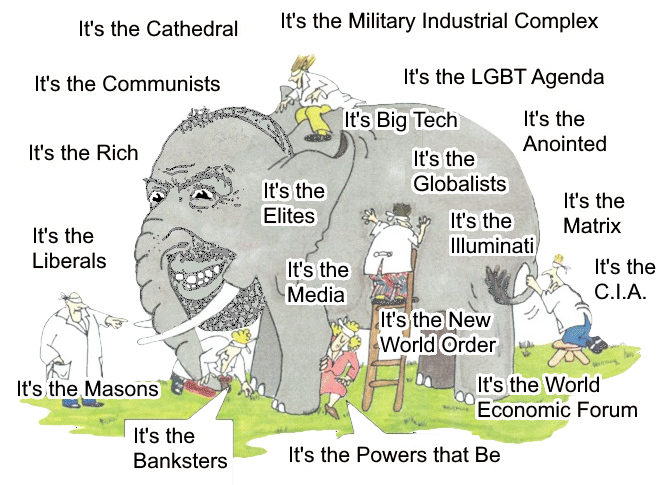

Meanwhile the controlled opposition successfully pit whites against muslims and vice-versa. So many psyops... and yet some still think the elites are stupid.

Zeb 摆烂

boosted

Zeb 摆烂

boosted

Zeb 摆烂

boosted

Zeb 摆烂

boosted

Zeb 摆烂

boosted

Zeb 摆烂

boosted

@Justicar it's quite simple. Women were given rights and they crashed the birth rates and voted for welfare. The welfare state needs workers which requires immigration since no one is having babies.

Giving women rights is why the West is collapsing. Taking them away is the only solution.

Zeb 摆烂

boosted

Zeb 摆烂

boosted

Zeb 摆烂

boosted

Zeb 摆烂

boosted

Zeb 摆烂

boosted

Impale the jews

Joined Nov 2023